Car Sales Tax Illinois Cook County . the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you. Tax rates provided by avalara are updated regularly. every new or used vehicle (cars, motorcycle, trucks, planes, boats, trailers) retailer must file a monthly use. For example, sales tax on a. There is also between a 0.25% and 0.75% when it comes. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. look up 2024 sales tax rates for cook county, illinois. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles.

from www.illinoistax.org

116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. Tax rates provided by avalara are updated regularly. every new or used vehicle (cars, motorcycle, trucks, planes, boats, trailers) retailer must file a monthly use. For example, sales tax on a. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. look up 2024 sales tax rates for cook county, illinois. There is also between a 0.25% and 0.75% when it comes. the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you.

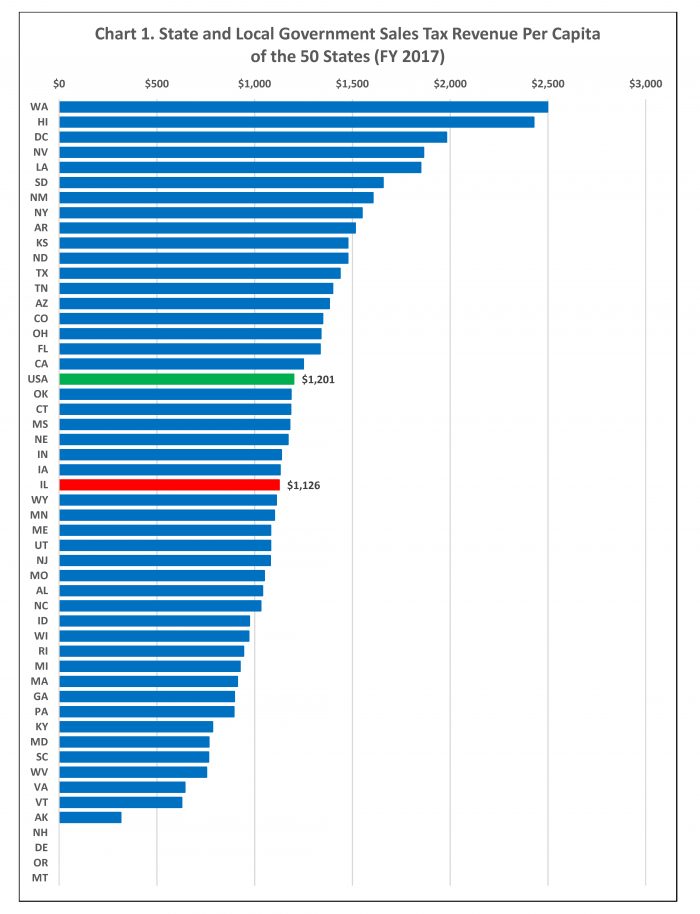

Taxpayers' Federation of Illinois An Illinois Sales Tax Conundrum

Car Sales Tax Illinois Cook County look up 2024 sales tax rates for cook county, illinois. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you. look up 2024 sales tax rates for cook county, illinois. There is also between a 0.25% and 0.75% when it comes. 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. every new or used vehicle (cars, motorcycle, trucks, planes, boats, trailers) retailer must file a monthly use. For example, sales tax on a. Tax rates provided by avalara are updated regularly. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles.

From abbypage.z19.web.core.windows.net

Illinois Vehicle Tax Chart Car Sales Tax Illinois Cook County 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. look up 2024 sales tax rates for cook county, illinois. Tax rates provided by avalara are updated regularly. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. every. Car Sales Tax Illinois Cook County.

From www.napletonshyundaiofurbana.com

New Illinois TradeIn Tax Starting Jan 1st, 2020 Napleton's Hyundai Car Sales Tax Illinois Cook County There is also between a 0.25% and 0.75% when it comes. Tax rates provided by avalara are updated regularly. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. look up 2024 sales tax rates for cook county, illinois.. Car Sales Tax Illinois Cook County.

From www.youtube.com

Illinois Sales Tax Explained Rates, Forms, Registrations, and More Car Sales Tax Illinois Cook County 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you. illinois car sales tax impacts how consumers in. Car Sales Tax Illinois Cook County.

From 1stopvat.com

Illinois Sales Tax Sales Tax Illinois IL Sales Tax Rate Car Sales Tax Illinois Cook County illinois car sales tax impacts how consumers in illinois are charged for their vehicles. the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you. Tax rates provided by avalara are updated regularly. For example, sales tax on a. 116 rows illinois. Car Sales Tax Illinois Cook County.

From pastureandpearl.com

Tax Sale Cook County April 2023 Car Sales Tax Illinois Cook County every new or used vehicle (cars, motorcycle, trucks, planes, boats, trailers) retailer must file a monthly use. the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles.. Car Sales Tax Illinois Cook County.

From www.datapandas.org

Car Sales Tax By State 2024 Car Sales Tax Illinois Cook County 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you. every new or used vehicle (cars, motorcycle, trucks,. Car Sales Tax Illinois Cook County.

From ledgergurus.com

Illinois Sales Tax LedgerGurus Car Sales Tax Illinois Cook County Tax rates provided by avalara are updated regularly. look up 2024 sales tax rates for cook county, illinois. 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. the. Car Sales Tax Illinois Cook County.

From taxsalestoday.blogspot.com

Tax Sales Illinois Tax Sales Rate Car Sales Tax Illinois Cook County For example, sales tax on a. There is also between a 0.25% and 0.75% when it comes. every new or used vehicle (cars, motorcycle, trucks, planes, boats, trailers) retailer must file a monthly use. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. look up 2024 sales tax rates for cook county,. Car Sales Tax Illinois Cook County.

From taxfoundation.org

How High Are Sales Taxes in Your State? Tax Foundation Car Sales Tax Illinois Cook County the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you. There is also between a 0.25% and 0.75% when it comes. Tax rates provided by avalara are updated regularly. 116 rows illinois has a 6.25% sales tax and cook county collects an. Car Sales Tax Illinois Cook County.

From www.illinoispolicy.org

Sales tax hikes take effect in 50 Illinois taxing districts Car Sales Tax Illinois Cook County every new or used vehicle (cars, motorcycle, trucks, planes, boats, trailers) retailer must file a monthly use. There is also between a 0.25% and 0.75% when it comes. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. look up 2024 sales tax rates for cook county, illinois. the amount that you. Car Sales Tax Illinois Cook County.

From www.caranddriver.com

What Is Illinois Car Sales Tax? Car Sales Tax Illinois Cook County the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you. There is also between a 0.25% and 0.75% when it comes. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. Tax rates provided by avalara are updated. Car Sales Tax Illinois Cook County.

From www.chegg.com

Solved New car sales for a dealer in Cook County, Illinois, Car Sales Tax Illinois Cook County the amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. For example, sales tax on a. look up 2024 sales tax rates for cook county, illinois. There. Car Sales Tax Illinois Cook County.

From webinarcare.com

How to Get Illinois Sales Tax Permit A Comprehensive Guide Car Sales Tax Illinois Cook County Tax rates provided by avalara are updated regularly. There is also between a 0.25% and 0.75% when it comes. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. every new or used vehicle (cars, motorcycle, trucks, planes, boats, trailers) retailer must file a monthly use. For example, sales tax on a. look. Car Sales Tax Illinois Cook County.

From classiccarwalls.blogspot.com

Average Sales Tax On A Car In Illinois Classic Car Walls Car Sales Tax Illinois Cook County look up 2024 sales tax rates for cook county, illinois. There is also between a 0.25% and 0.75% when it comes. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in. Car Sales Tax Illinois Cook County.

From www.chegg.com

Solved New car sales for a dealer in Cook County, Illinois, Car Sales Tax Illinois Cook County illinois car sales tax impacts how consumers in illinois are charged for their vehicles. 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. the amount that you have to pay for your illinois used car sales tax or your illinois new car sales. Car Sales Tax Illinois Cook County.

From www.taxpayereducation.org

ILLINOIS SALES TAX RATES AMONG THE HIGHEST IN THE COUNTRY! Taxpayer Car Sales Tax Illinois Cook County Tax rates provided by avalara are updated regularly. For example, sales tax on a. 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. illinois car sales tax impacts how consumers in illinois are charged for their vehicles. every new or used vehicle (cars,. Car Sales Tax Illinois Cook County.

From www.carsalerental.com

Illinois Used Car Bill Of Sale Pdf Car Sale and Rentals Car Sales Tax Illinois Cook County 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum sales tax rate in cook. every new or used vehicle (cars, motorcycle, trucks, planes, boats, trailers) retailer must file a monthly use. There is also between a 0.25% and 0.75% when it comes. the amount that you have to. Car Sales Tax Illinois Cook County.

From wisevoter.com

Car Sales Tax by State 2023 Wisevoter Car Sales Tax Illinois Cook County every new or used vehicle (cars, motorcycle, trucks, planes, boats, trailers) retailer must file a monthly use. Tax rates provided by avalara are updated regularly. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. 116 rows illinois has a 6.25% sales tax and cook county collects an additional 1.75%, so the minimum. Car Sales Tax Illinois Cook County.